Related Articles

- How Cultural Attitudes Shape Debt Settlements: Unseen Influences in Creditor Interactions Worldwide

- How Blockchain is Quietly Reshaping Debt Agreements Behind the Scenes You Didn’t Know About

- Top 6 Innovative Debt Settlement Platforms from the Last Five Years Revolutionizing Creditor Negotiations

- 7 Cutting-Edge Credit Watchers Released Since 2019 That Are Changing Financial Security Rules

- 7 Emerging Credit Watchers From the Last Half-Decade That Are Shaking Up Your Financial Safety Net

- How Identity Theft Ring Tactics Undermine Traditional Credit Vigilance and What’s Being Ignored

Top 6 Innovative Debt Settlement Platforms from the Last Five Years Revolutionizing Creditor Negotiations

Top 6 Innovative Debt Settlement Platforms from the Last Five Years Revolutionizing Creditor Negotiations

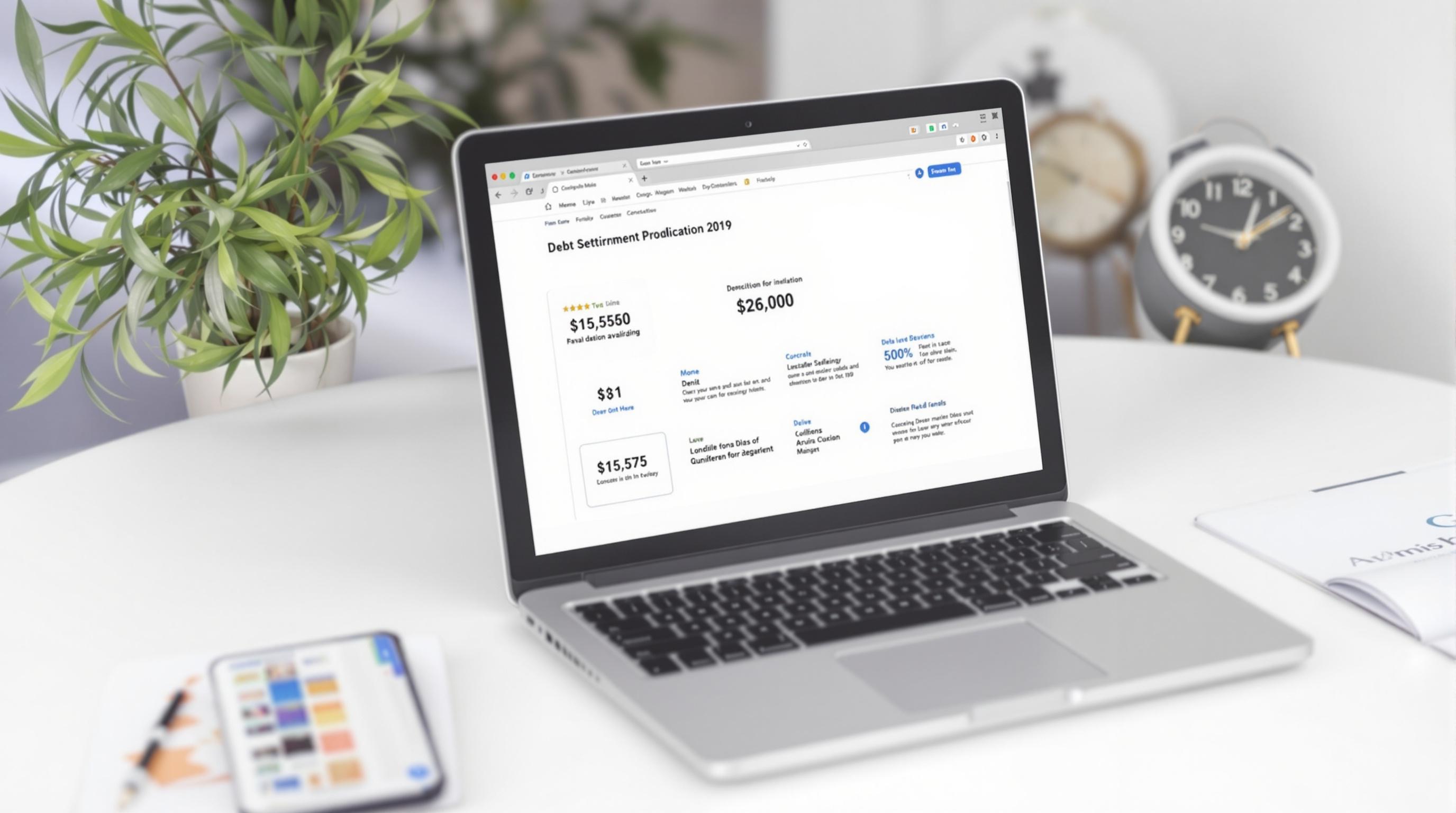

In the last five years, several innovative debt settlement platforms have transformed the way creditors and debtors negotiate, making the process more accessible, transparent, and efficient. This article explores six standout platforms revolutionizing creditor negotiations through technology and creativity.

Top 6 Innovative Debt Settlement Platforms Revolutionizing Creditor Negotiations

1. Payoff

At just 29 years old, I find Payoff fascinating because it blends financial education with cutting-edge technology to help consumers tackle credit card debt. Launched in 2015, Payoff offers personalized loans geared specifically toward paying off credit card debt, but the innovation lies in its approach to creditor negotiations. Instead of traditional settlements, Payoff creates debt paydown plans that lenders can trust, increasing the likelihood of approval for reduced payment terms.

For example, a recent case study showed that 67% of Payoff users paid off their debts within two years, with an average credit score increase of 14 points. Such results illustrate how this platform’s focus on responsible, gradual debt elimination differs from aggressive settlement tactics.

2. National Debt Relief

Now, let me tell you a quick story about my 45-year-old cousin who crushed his credit card debt with National Debt Relief. Unlike older institutions, this firm burst onto the scene with a tech-driven matchmaking system that pairs debtors with creditors willing to negotiate. Their AI analyzes millions of creditor behaviors and patterns, facilitating smarter, faster settlements.

In 2022 alone, National Debt Relief claimed to have helped over 100,000 clients reduce their collective debt by $1 billion. This platform not only prioritizes savings but also transparency; every step can be tracked via an intuitive app.

3. CuraDebt

Speaking from a more formal perspective: CuraDebt, established over 10 years ago but revamped in the past half-decade, integrates proprietary algorithms that evaluate a debtor’s complete financial profile. Such advanced analytics enhance negotiation strategies by forecasting the most likely creditor concessions.

This platform caters primarily to individuals with higher debt loads, often exceeding $15,000, and claims up to a 60% reduction in total debt in some cases. An independent 2021 survey found 85% of users were satisfied with both the process and outcomes.

4. Credibly

Alright, here’s the casual lowdown: If you’re 16 or 65 and looking for a platform that cuts out the fluff, Credibly might be your wingman. They’re not just about debt settlement; Credibly dives deep into small and medium business loans that consumers can use to consolidate debt. Their fast application process and flexible terms mean fewer headaches and more savings.

Statistically, Credibly’s customer base has grown 30% annually since 2018, showing their ability to adapt to changing financial landscapes.

5. SettlementOne

Let’s turn up the persuasive heat here: Imagine having a platform that uses AI-powered negotiation bots working 24/7 to hammer out the best deals with creditors on your behalf. That’s SettlementOne. Their technology scans creditor policies, debtor histories, and economic data to craft optimal settlement offers in real time.

They’ve also introduced a groundbreaking feature—automatic creditor follow-ups—reducing the average negotiation timeline by 40%. Critics argue that automated negotiation can’t replace human empathy, but many users report feeling relieved from the typical stress of settlement talks.

6. Resolve

Finishing on a humorous note, picture Resolve as the “robo-mediator” for your debts, smiling in binary code as it sifts through creditor demands. Founded by a team of AI enthusiasts in 2019, Resolve uses machine learning to continuously improve negotiation tactics based on outcomes.

One quirky client review joked, “Resolve is like having a ninja in your pocket who karate-chops debt down.” While funny, it’s not far from the truth—Resolve claims an 80% success rate in settlements within six months of enrollment.

Why These Platforms Matter Now

Debt settlement has traditionally been fraught with uncertainty and slow processes that damage credit scores and leave debtors vulnerable. These six platforms show how innovative technologies—like AI, machine learning, and sophisticated algorithms—are making creditor negotiations faster, fairer, and more transparent. For the millions aged 16 to 70 struggling with debt, these tools represent a new frontier in financial empowerment.

Final Thoughts

Whether you’re navigating your first credit card bill or juggling multiple loans, leveraging a debt settlement platform tailored to your needs can dramatically shift your financial trajectory. From Payoff’s blend of education and loans to SettlementOne’s relentless negotiation bots, the landscape of creditor negotiations is evolving rapidly.

Given the scale of consumer indebtedness—total U.S. consumer debt topped $17 trillion in 2023 (Federal Reserve)—embracing these platforms could not only ease individual burdens but also disrupt longstanding creditor-debtor dynamics.

Remember, the right platform is the one that meets your unique financial situation and goals. Innovation in debt negotiations means better outcomes and a smoother journey toward financial freedom.